Fiber Laser Cutter History Paves The Road For TuscoMFG’s Most Recent Investment

Fiber laser cutters significantly advanced metal cutting, offering benefits of precision and speed not possible with traditional CO2 lasers or other cutting methods.

Our comprehensive, in-house metal fabrication services offer a full range of custom manufacturing solutions to fulfill all of your requirements in one place.

Let us build your brand story with our team of experts. Tusco offers a complete solution for designing, engineering, and manufacturing custom, in-store displays and fixtures.

Tusco excels as your partner in development. We help you take your project from idea to delivery with our proven project management process.

Our manufacturing roots run deep. Since 1949, we set ourselves apart from our competitors by leaning into ingenuity and solving client problems with innovation.

Our solutions are tailored specifically to your project.

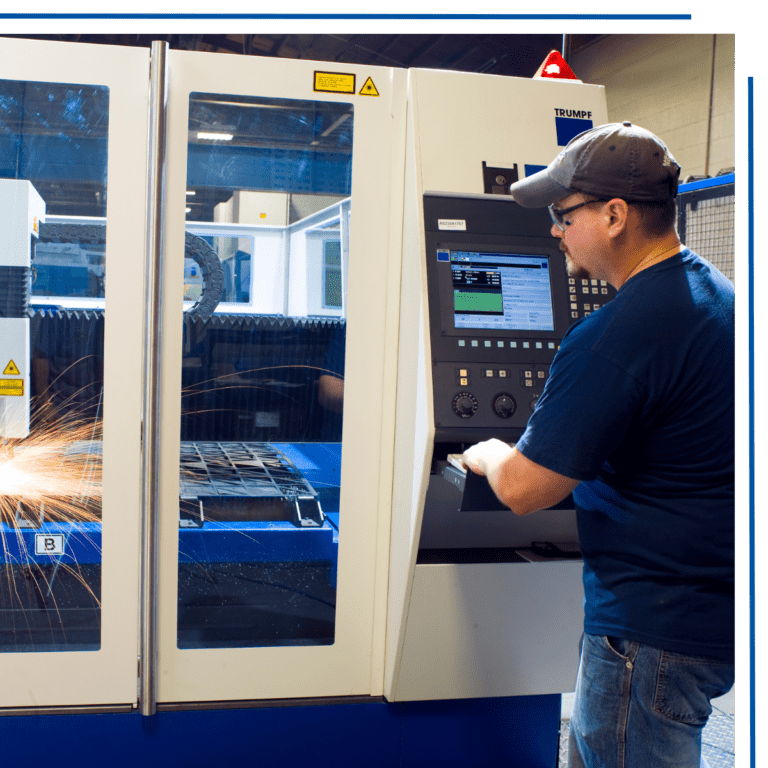

Custom laser cutting with our Trumpf Trulaser 5030 laser.

Varied brake presses provide the perfect form.

Certified MIG and TIG welders are supplemented by robotic welders.

Powder coating protects your product and sets it apart from the competition.

Woodworking solutions create one-of-a kind, mixed-media projects.

Everything from screenprinting to packaging can be done before shipping your project out.

Our on-site warehouse is available to allow us to directly drop ship your project anywhere.

From retail displays to custom fabrication, Tusco stands out with our innovative ideas to take your project to the next level. We have 40+ years of experience in the custom retail display industry and 70+ years in custom metal fabrication.

Fiber laser cutters significantly advanced metal cutting, offering benefits of precision and speed not possible with traditional CO2 lasers or other cutting methods.

Effective communication is the lifeblood of any successful endeavor, and custom metal fabrication is no exception. When collaborating with a custom metal fabricator, clear and open lines of communication are essential.

Learn more about the importance of choosing a metal fabricator who can help you optimize flow for greater production efficiency.

ISO 9001:2015 demonstrates our commitment to a robust quality management system.

UL 48 safety standards apply in all cases where our team is designing signage that requires lighting such as LED, fluorescent, incandescent, and HID.